Bill Hornbuckle is urging the legal sports betting industry to handle the prediction market battle properly to avoid federal intervention.

As Bill Hornbuckle travelled to Atlantic City this week for a prominent gaming conference, the legal sports betting industry nationwide continued to race toward a proverbial fork in the road.

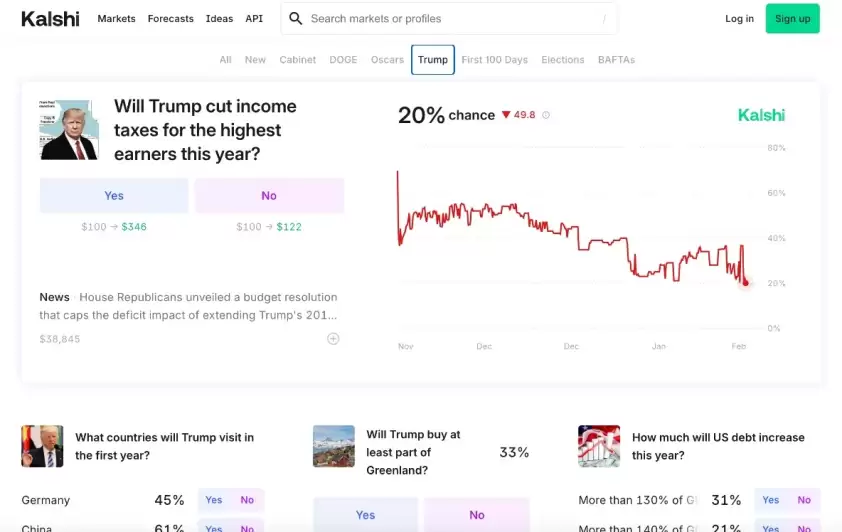

Days earlier, Kalshi had reported handle of $86 million (£65 million/€75.6 million) during The Masters tournament, roughly three times the volume traded on the platform for the Super Bowl. Over the last month, Kalshi and other prediction markets have been subject to a wave of cease-and-desist orders from states around the country. The litigation comes as the US Commodity Futures Trading Commission (CFTC) prepares this month for a highly awaited roundtable on the regulatory implications of sports event contracts.

Operating tax free on trading revenues, prediction markets pose an existential threat to the regulated gaming industry in the view of some industry ..